Once your LOI is undersigned (read more here), you enter the exclusivity period, and a clock starts ticking. Usually, you have a few weeks to run due diligence, identify Red Flags, and participate in a red flag meeting.

How to structure your RfP (request for proposal) in order to be sure, you get a proposal for a tax due diligence you really want? Learn a few tips from several years of our experience.

TIP #1 Learn how long the review period you are interested in

Usually, advisors tend to offer either a 2-3-year period covered by their due diligence (you may read about 2 full tax years back and the current tax year up-to-date) or coverage of a full tax statutory prescription period (ca. 6 years in Poland). Which one is better? It all depends on your preferences and – obviously – budget.

If the target entity has a plain legal form, no past restructurings were disclosed or the target has been quite recently set up, then a shorter DD coverage will most probably do no bigger harm. You may also like to agree with the advisor that if they discover any errors, risks, omissions, etc. That is of a systematic nature, they will flag it to you, and you will then decide if to expand the DD coverage or not.

In case the target company has existed for many years, you are not certain if professional advisors have been involved so far, it has undergone some restructurings or your company is risk-averse, then you might need a full-scope DD coverage.

TIP #2 Define materiality level

A tax due diligence is run based on a sample method. However, when choosing a sample, advisors assess the scale of the project and the agreed materiality level. Think about the value of testing below which you agree to have no testing. Do you want the advisors to test based on per-item materiality level or basket materiality level is acceptable for you? If not given, advisors will usually propose a level that is in line with their most common practice.

Tax & Accounting Trends for Real Estate

Subsribe to our real estate newsletter to receive a free-of-charge PDF with some practical examples of tax phrases used in LOIs in Polish real estate market.

TIP #3 Define the scope of analysis

For an asset deal, you will need more focus on the VAT history of the target project rather than hanging over the whole tax history of its owner. So, the scope is narrower.

For a share deal, however, you will take over the whole tax history of the target company (and related risks and liabilities), so a more prudent approach is recommended. You may like to consider the following aspects:

- Employees and payroll analysis – have they been employed in the target company?

- Tax losses – if you do not take them over, then you may only need to compare their volume with any identified risk items rather than run an additional forecast of their utilization potential.

- Transfer pricing – usually only TP compliance is being investigated (and not the correctness of benchmark analysis).

- Restructurings – how complicated is the history of the target company and whether there have been any restructurings performed?

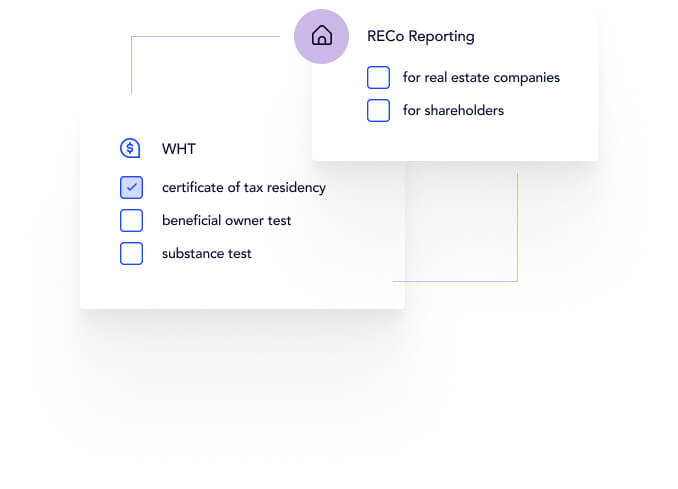

- Cross-border payments – is there any specific relation involved, where withholding taxes or taxes on shifted income may be applicable?

TIP #4 Fixed asset register – do not limit it

For share deals, please remember that the real estate property is being depreciated usually for 40 years and it is a main asset of the real estate company. Thus, we suggest not limiting the testing of fixed asset registers under the scope of the proposal. Anyhow, due diligence analysis is based on the existing audit trial. In case it is of poor quality, it already imposes some limits for testing.

TIP #5 Past restructurings – in or out of scope?

Some investors, to limit their cost of acquisition, cross out of the tax DD scope analysis of any restructurings made in the target company. Such an approach may be beneficial if implemented in the first stage of DD. However, after any first red flags, it is worth considering if leaving it out in comparison to cost saving is effective.

On the other hand, analysis of restructurings always takes more time and requires more resources than the regular tax DD of a running business, so advisors tend to price it separately.

TIP #6 Provide some key data of the project/target company

For the advisors to assess the volume of capacity required for the project (and to give you a better-fit proposal), they need to know more about it. This data will be helpful:

- scale of the project (transactional volume, also sqm)

- number of tenants

- vacancy rate

- info about the owner and type of project (JV, forward funding, purchased, contributed in-kind etc.)

- date of putting the property into use (occupancy permit)

- Info about accountants, lawyers, advisors of the other party (internal/external, teams dedicated to your industry or general)

- Info about the availability of VDR (virtual data room) or a need to perform on-site visits