Due diligence analysis is very often aligned with the acquisition of target companies [share deals]. However, it may be also very helpful in real estate asset deals, taking into consideration the intricacies of the Polish VAT law.

VAT taxation scheme

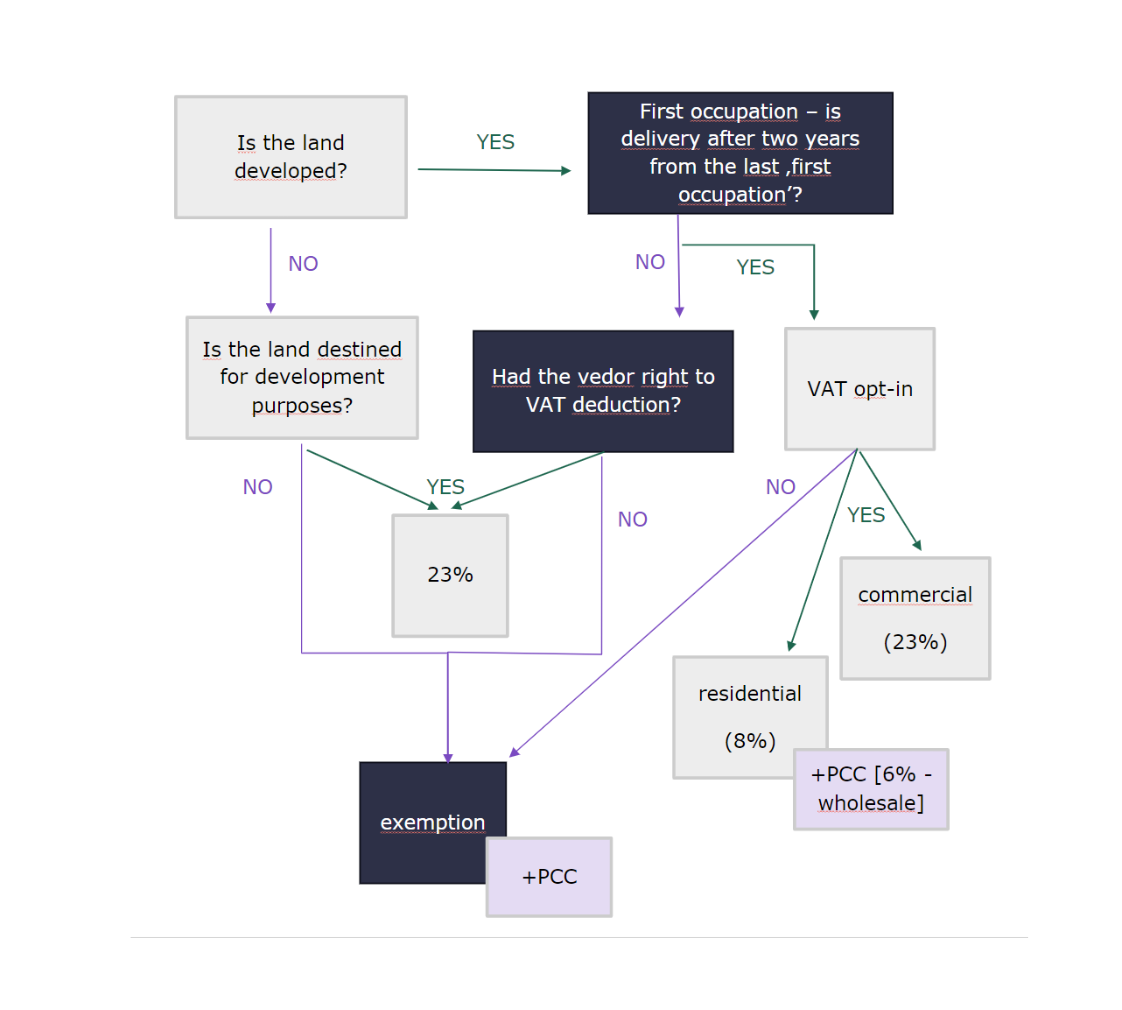

Taxation of real estate asset deals in Poland very often is brought to opt-in option and tax ruling. However, to get there, you need to go through the taxation algorithm and eliminate different options, in particular obligatory VAT exemption, which may end up with a lack of neutrality of acquisition and sales. Here is what this algorithm looks like and the dark route is the one that usually transactional parties want to avoid.

Click on the image to learn more in 5 minutes

Scope of review

Within the asset deal tax DD, the following major points are being checked

1. First occupation – term allowing to choose a proper route of algorithm to opt-in to VAT-neutral transaction for the buyer. The name may be a bit misleading, as it may appear more than once throughout the property’s life cycle.

2. VAT history of the property – in particular right to input VAT deduction by the vendor, which determines also the way how the planned transaction is taxed. It is good to remember that, contrary to civil law perspective, for VAT it is the building and other real estate properties located on the land that determine the correct VAT taxation.

3. Fixed asset register – in terms of major initial value tax increases due to CAPEX, as it is strictly connected with the ‘first occupation”

4. Nuances resulting from tax law interpretations – such as how to tax always vacant premises, how to count the 30% initial value increase, what lack of input VAT deduction means in the context of PCC taxed past acquisitions, etc.

5. Document-based verification of the factual background – useful for the proper preparation of tax ruling applications, allowing them to achieve their best protective function and to mitigate any future tax risks, also on the future exit.

See what you may gain

– verified insert into the tax ruling

– sign-off & reliance letters for insurers or financing banks

– risk mitigation on VAT refund [and the buyer’s liability]

– verified basis for purchase price split

– sound defense file for future exit